How We Do It

afs is Applied Financial Services.

Applied / adj. put to practical use, as opposed to being theoretical.

Oxford English Reference Dictionary

Balance Sheet Risk Management Projects

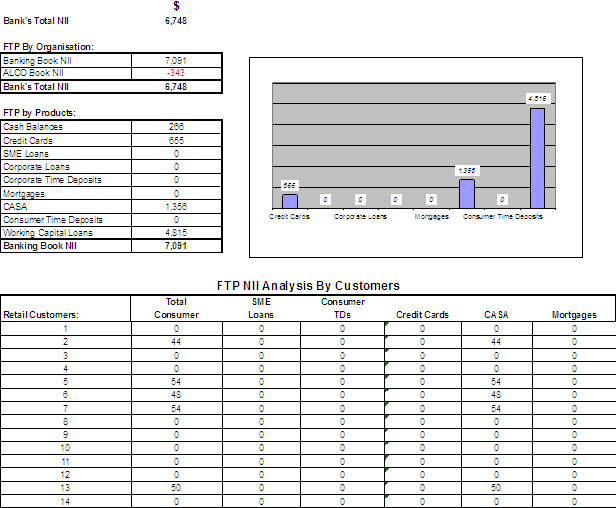

- Establish Funds Transfer Pricing, Asset Liability Management and Central Funding Unit for balance sheet risk management

- Establish FTP Methodology blueprint through understanding product features, customer behaviour and local market conditions

- Converge agreement among stakeholders for the FTP Methodology, and hold 1st FTP Meeting at ALCO to approve and sign-off the methodology

- Carry out systems evaluation for an integrated FTP/ALM/Risk management system, through preparation of Request for Proposal, development of a proof of concept script, evaluating short-listed vendors and making a recommendation to the bank

- Develop FTP Curve construction methodology, Asset Liability Management policies and procedures, FTP policies and procedures and FTP Risk Management policies and procedures

- Conduct FTP/ALM/risk management workshops in the bank to ensure that there is sufficient knowledge and skills transfer to sustain the new FTP/ALM/risk management

- Build the FTP/ALM organisation - ALCO will be able to use the FTP/ALM systems to manage its balance sheet, profitability and capital, and the risks that are taken by the bank as a result of its banking book activities.

- Principal Component Analysis of Market Rates Structures

PCA of Sri Lankan Interest Rates Curve

Training

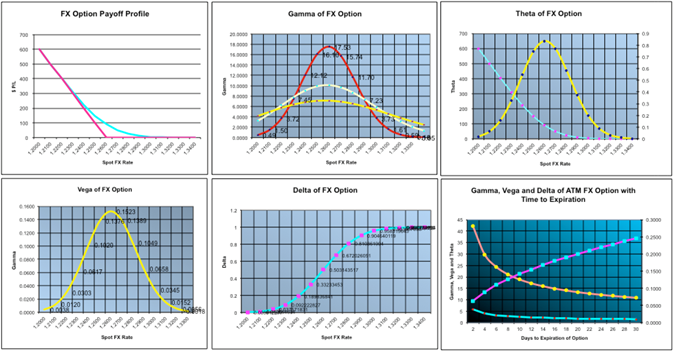

- Computer simulation of Option Risks

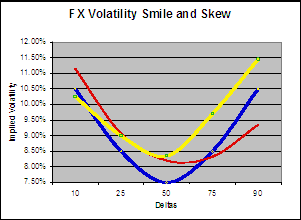

- Computing Volatility Surface

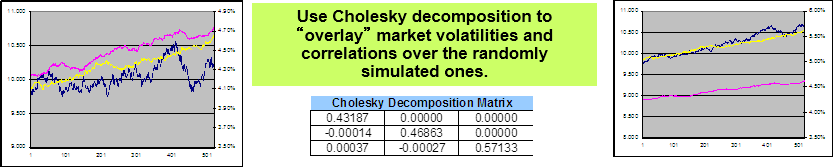

- Monte Carlo Simulation

- Funds Transfer Pricing Simulation

Global Treasury Projects

- Treasury and derivative products – features, risks, pricing, hedging

- Market risk management – foreign exchange, interest rate, derivatives and structured products

- Dealing room operations

- Set up trading limits by asset class for dealing operations

- Model validation for derivative products, including establish valuation and reserves policies

- Middle office and product control

- Evaluation of Treasury Competencies of Treasury Risk Management

- Establishing policies to manage Fraud and Rogue Trading Risks

- Evaluation of Front, Middle and Back Office systems for Treasury

- Establish Key Risk Indicators for Continual Self-Assessment of Treasury Risks

Activity Based Costing Projects

- Institutional Cash Equities Project

- Client wanted to develop a client profitability MIS which helps it to redefine its business model for its institutional clients in terms of its sales function, sales execution, dealing and research.

- An Activity Based Costing model was built for the Client that took into account the costs of service of different client tiers and segments in different markets. This model was automated on MS Access, which provides the bank with information on the profitability ranking of all clients, client segments, markets, etc.

- This profitability and cost information allows the bank to structure its level of service according to each client’s needs, and to respond to market cyclicality more efficiently.

Regionalisation of Back-office Projects

- Regionalisation of Private Bank Back Office Project

- Re-organised the private bank business and operations into new legal entities.

- Built the operational model for the new entity.

- Applied for new banking licenses in Singapore and Hong Kong through the Monetary Authority of Singapore and the Hong Kong Monetary Authority, respectively.

- Consolidated the back-office processing functions of its private banking operations in Singapore.